With all the home loan options how do you know which option is best for you?

Items to Consider

- How much money do you have for a down payment, this is key when shopping for a mortgage

- The amount of years you want to loan to be and how long you plan on staying in the property

Before you start looking at new homes its important you have already started the pre-approval process with a mortgage lender and know which loan is best for your situation. This will help your realtor plan the right location and price range as you look at potential homes.

Here are a few things to consider when asking for a loan quote.

Conforming Loan Vs. Non-Conforming Loan

A conforming loan is mortgage loan that meets the requirements to be sold to Fannie Mae, Freddie Mac, the Federal Housing Administration (FHA), USDA or Department of Veterans Affairs (VA). The limit on conforming loans varies depending on where you live but, for most of Texas, the maximum you can borrow with a conforming loan for a single-family-residence is $484,350 in 2019 for a conventional mortgage. Find out the conforming loan limits for your area on the Federal Housing Finance Agency.

It is possible to borrow more if you qualify for a jumbo loan.

A jumbo loan is known as a non-conforming loan and comes with a slightly different set of requirements than a conforming loan. You may need a higher credit score—a FICO Score of 680 or more—and a lower debt-to-equity ratio than a lender would require for a conforming loan. For example, you may be required to have a 20% down payment, compared to having the option of putting down as little as 5%, in some cases 3%, on a conventional, 30-year loan.

Another type of a conforming loan is a Federal Housing Authority (FHA) loan. These loans have slightly relaxed requirements compared with non-conforming loans as jumbo loans. They’re designed for first-time homebuyers, people who have less-than-perfect credit, or buyers who can only afford to make a small down payment. The minimum required down payment is 3.5%, and you may qualify for an FHA mortgage with a credit score of 580 or more. There are limits on the amount you can borrow with an FHA loan as well, but it varies based on location. In most areas in Texas, the lending limit for FHA loans is $331,200.

Private Mortgage Insurance or 2nd Mortgage Loan

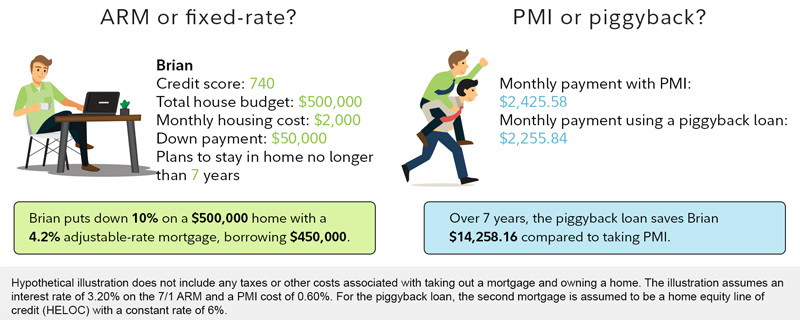

Putting down at least 20% of the loan amount is ideal—but if you can’t come up with 20%, it’s not a deal breaker. You can still get a loan, but you will likely need to pay for private mortgage insurance (PMI), which can be costly over time.

PMI costs vary depending on your loan amount, loan term, down payment, credit score, and even the insurance company you choose. The cost typically ranges from 0.25% to 2% of your loan balance each year. In general, a higher down payment as a percentage of the home value often translates to a lower rate on PMI. For example, if you only have a 5% down payment, the PMI on your loan is likely to be 2%; with a 15% down payment, the PMI on your loan might be as low as 0.50%.*

The good news is that you can get rid of PMI eventually. When your outstanding loan balance drops to 80% of your home purchase price, or current market price, you can request that the insurance be canceled. The lender should automatically cancel PMI when the balance of your loan drops to 78% of the loan amount, as required by the Homeowners Protection Act. Another way you may be able to cancel PMI is through price appreciation—if your home appreciates in value, the loan-to-value ratio decreases. Check with your lender to see whether they allow PMI to be canceled due to rising market values.

Paying for mortgage insurance isn’t the only option if you lack a 20% down payment. Another solution would be to take a piggyback loan in order to bring your down payment to 20% of the purchase price. A piggyback loan is a second mortgage on your home taken at the same time as the first mortgage.

The most popular scenario using a piggyback loan is the “80-10-10.” This means that 80% of your home purchase price is covered by the first mortgage, 10% is covered by the second mortgage, and the remaining 10% is your out-of-pocket down payment. If you qualify you can also have the option of putting 5% down payment.

Keep in mind that the interest rate for the piggyback second mortgage is typically much higher than the rate on the primary loan. One silver lining is that you may be able to deduct the interest paid on the piggyback loan from your taxes and you will avoid the monthly PMI.

Mortgage insurance is a little different for FHA loans. FHA loans are insured by the US Federal Housing Administration. With an FHA loan, you’ll have to pay a 1.75% up-front mortgage insurance premium and an annual mortgage insurance premium for the life of the loan. The amount of the premium is based on the loan term and amount borrowed. The range for typical 30-year FHA loans is from 0.80% to 1.05% annually.

Fixed-rate mortgage or adjustable-rate mortgage

This might be one of the most important decisions you need to make when it comes to your mortgage—after deciding how much mortgage you can really afford. With a fixed-rate mortgage, the interest rate on your loan remains the same for the life of the loan. Your monthly mortgage payment is fixed and won’t change.

With an adjustable-rate mortgage (ARM), the interest rate is fixed for a predetermined number of years, and then it fluctuates, within limits, for the remaining term of the loan. An example is a 7/1 ARM. The 7 refers to the number of years before an adjustment can be made. After the seventh year, the loan may adjust every year. Rate changes are determined by a benchmark index plus a margin percentage set by the lender. There’s typically a cap on the amount the loan can adjust per year and how high it can go over the life of the loan.

One thing to beware of with an ARM is that after the fixed-rate period, you are subject to the vagaries of prevailing interest rates. If you are risk averse or you expect rates to rise, a fixed-rate loan might be a better choice. You can lock in the current rate without worrying about future interest rate changes. If interest rates dip in the future, you can choose to refinance into a lower-rate loan.

Tip: If you know you will only live in the new home for a few years and have already analyzed the economic implications of buying versus renting for a short period of time, it might make more sense to choose an ARM instead of a fixed-rate mortgage. Lenders offer varying terms on ARMS—3/1, 5/1, 7/1, or even 10/1. If you are confident you will live in the home for a set number of years, you won’t need to worry as much about future rate adjustments, and you’ll potentially get a lower rate than you could with a fixed-rate loan.

15-year or 30-year

After the fixed-rate or adjustable-rate decision, the next consideration is how long you plan to borrow. The most common loan terms are 15 and 30 years. The benefits of a 15-year fixed-rate mortgage include a lower interest rate relative to a 30-year loan and a much shorter mortgage term. The total interest cost for a 15-year loan will be significantly lower than a 30-year loan, but it will have a higher monthly payment.

For example, compare 2 fixed-rate loans for $300,000—one with a 4.20% interest rate over 15 years and another with a 4.75% interest rate over 30 years. The monthly payment on the 15-year loan will be $2,249, whereas the 30-year loan will have a monthly payment of $1,565. Over the life of the 30-year loan, the total interest cost will be $215,609, but just $72,914 for the 15-year loan. That’s a savings of $142,695 in interest—almost half of the initial loan balance.

Even more types of mortgages

There are some lesser known and less commonly used types of mortgages.

VA loans are guaranteed by the US Department of Veterans Affairs. The loans are designed to provide eligible service members, veterans, and surviving spouses with affordable home mortgages. VA loans accept 100% financing without PMI for first mortgages or 20% financing for second mortgages. A VA funding fee ranging from 0.00% to 3.30% is required for eligible borrowers, which could be financed as well. Just like other types of mortgages, there is typically a cap on the amount you can borrow, but it varies by area.

Interest-only loan

If you have a limited monthly housing budget for a short period of time (like 3 to 10 years) but anticipate a much higher budget after that, an interest-only loan might be an option for you. With an interest-only loan, you pay only the interest on the loan for a specified number of years. After that, you are required to repay both principal and interest each month.

Interest-only loans usually come with much higher interest rates compared with conforming loans. Another thing to beware of is that taking an interest-only loan could lure you into buying a home you can’t really afford. Though the payments may be comfortably low at the beginning, it can come as a shock when it’s time to begin repaying the principal plus interest.

Know your loans

It’s important to know all your options so you can make the best choice when it’s time to buy a home. Understanding how mortgages work, your budget, and time frame can help you pick a loan that fits your situation—and can potentially save you thousands of dollars over many years.

For more information about our loans, their benefits and loan options and how it may apply to you, please contact us direct at 281-627-4222 or submit the quick quote form on this page.